Buy now, pay later (BNPL) schemes are surging in popularity amongst retailers and consumers, but there could be a downside - such schemes are attracting the attention of the credit industry as credit risk becomes a greater concern.

According to credit firm ClearScore, consumers risk damaging their credit scores for ‘years to come' because vulnerable consumers are ‘loading up on unregulated products'.

ClearScore studied the spending attitudes of more than 1000 Australians. The company found there has been a 30% rise in the number of consumers using multiple BNPL accounts. Furthermore, the number of consumers missing repayments has increased 83%, with one in three consumers claiming to have missed BNPL repayments.

While some BNPL providers do credit checks to assess consumer suitability, they're also more than happy to take advantage of steep late fees.

ClearScore Australia managing director Steve Smyth says that sooner or later, consumers will be stung with those steep late fees because they fail to keep up with repayments.

“When those debts are sold on to collection agencies, they will show up as multiple defaults, even if the dollar amount defaulted is comparatively small. This is a consumer credit access horror show in the making.

Most BNPL transactions also fail to conduct external credit health assessments so there is no way of telling how financially healthy BNPL customers are.

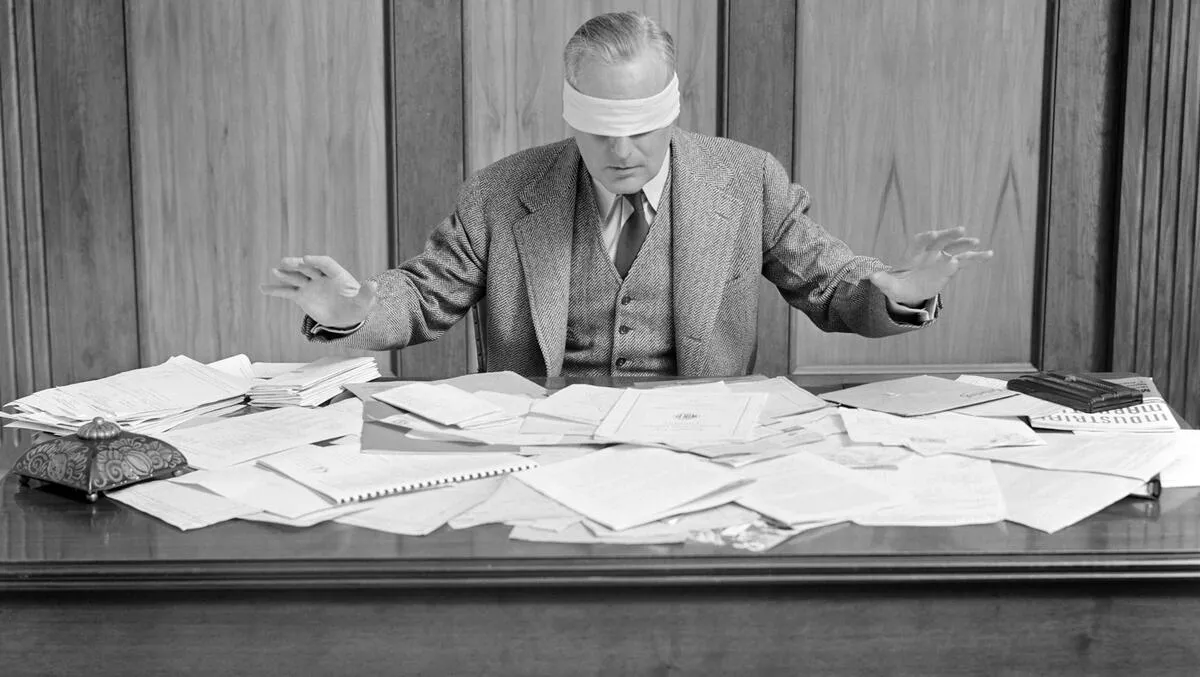

Smyth says the BNPL industry is flying blind.

“The real issue is that regulators have over-regulated responsible lending and reduced competition in credit for lower income customers. This removes affordable credit options, so the only option for many consumers is to take out multiple BNPL accounts, without adequately checking affordability. This is building up to be a trainwreck for vulnerable customers and the question for regulators is whether they will prevent substantial consumer detriment – or are they just going to intervene after the real harm is done?

Speaking specifically about Australian regulations, Smyth believes that the responsible lending obligations already comparatively tight for mainstream credit products such as credit cards, mobile plans, car loans and mortgages, those who could benefit the most from credit could be unintentionally locked out of the market.

“Think about a 30-something tradie that needs a loan to buy a ute and some tools to start out on his own,” Smyth said. “A damaged credit record could affect his life for years to come.

Last year the Australian Securities and Investment Commission found that one in five consumers ends up missing payments.